IT Teams Into Demonetization Action!

IT Department Served Notices To Deposits Above 2.5 Lakhs

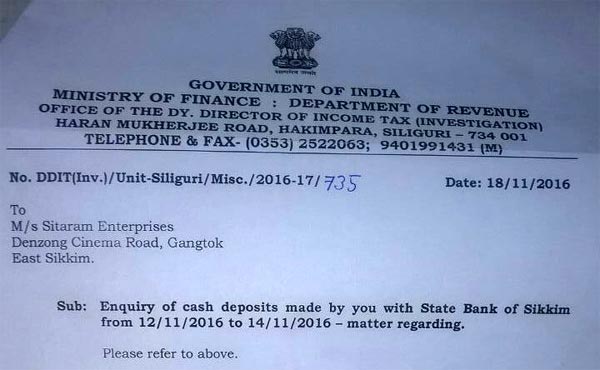

The main purpose behind PM Narendra Modi’s demonetization announcement is to rule out the very existence of black money at the grass root level. Lending the support, Income Tax Department officials have immediately got into action and served hundreds of notices to all the individuals and firms who have deposited more than Rs.2.5 Lakhs into their respective bank accounts in the denominations of scrapped Rs. 500 and 1000 notes.

IT has begun a National wide enquiry issuing notices under section 133 (6) of the Income Tax Act (power to call for information) to many of the bank account holders. These suspicious volumes of cash deposits are questioned to check the instances of tax evasion, money laundering and black money.

Those received the notices have to bring supporting documents, books of accounts, bills and a copy of Income Tax Return of last two years to explain the said cash deposits before respective of Income Tax authority.